While large parts of Bangkok are owned by the Crown Property Bureau (CPB) and other large state landlords since 2004’s property boom until today the city has remained mostly a freehold condo market. Today we look at why leasehold is appearing now in increasing numbers, how to price it, and whether you should be adding leasehold to your portfolio.

Background

Since the mid 2000s developers have swept up many of the best plots in the CBD, and at today’s prices (as high as 2MB+/sq.w.) the site needs to be maximized, meaning high-rise high density. But even then the land in some prime locations is now increasingly difficult to buy. Additionally, CPB, Chula, MOF and others are recognizing value of creating ‘superblocks’ leasing oversized plots by combining previously smaller sites eg Langsuan.

Leasehold in other countries is common, often 50,60,99 or even 999 years in term. Thailand only recognizes 30 years for residential and 50 years for commercial/hospitality, a relatively short term.

So leasehold sites tended to be developed into offices, shopping centers or hospitality where the income of leasehold matches freehold, but the underlying land is cheaper.

Residential leasehold is different, as most people buy to own, so it has sold slower than freehold for reasons we’ll talk about, but now some developers are betting it’s different now due to lack of freehold in prime neighborhoods and knowing key Chinese and Hong Kong buyers will find it easier to buy leasehold which are common in their markets.

Why developers are pushing leasehold

– leasehold land is cheaper to buy, new superblocks concentrated around inner city (Lumpini, Langsuan, Ratchadamri, Makkasan)

– easier for Chinese and foreigners to buy (no need to show source of funds in most cases)

– no 49% foreigner restriction, can sell entirely to foreigners

– no Condo Act, developer can run the building with fewer legal restrictions

Buyers should consider leasehold for the cheaper prices in prime locations where freehold may be unavailable. There may be some tax benefits and foreigners can also benefit from the simpler buying process.

But……for Thai buyers there are some issues:

– you buy a depreciating asset (price typically increases slightly then gradually drops to near zero over 30 years/term of lease)

– uncertainty in property management with no protection from Condo Act

– difficult to get finance as Thai banks don’t lend on leasehold, which means difficulties in resale to non-cash buyers, combined with market preference for freehold

– last 10 years before lease expires building likely to experience issues as the systems stop working but it isn’t worthwhile to replace

– terms of leasehold renewal are unknown at time of purchase; despite what may be claimed at time of sale, Thai law typically does not allow registration of lease renewals after 30 years and certainly not after 60; developers have various mechanisms to attempt to answer this concern, but it cannot be known if the developer will still be the other party at time of renewal, of if laws can enforce these mechanisms. In some cases a fee is payable in some cases it is stated what this will be in other cases it isn’t

Developer research in the past identified that up to 70-80% of Thai buyers would not consider leasehold under any circumstance. However, it always depends on the price.

Fair Pricing

The common formula for 30 year leases is 30% less than freehold, but this is actually for land, not completed property. A developer has to invest the same for a freehold or leasehold building in everything except the land, so it seems like the cost difference would be less than 30%, however for the condo buyer the answer is “it depends”; the price difference has varied from 150 % at purchase time, with the gap growing after completion since freehold prices increase while leasehold will reduce. More importantly the absorption rate for leasehold is much slower so the usual ‘kick’ for flippers and investors is less likely as developers still have considerable inventory at completion.

datapoints

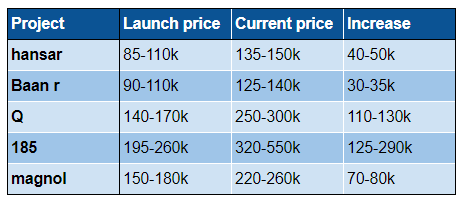

Hansar, Baan Ratchaprasong and Q Langsuan were all completed around 2009. 185 Rajadamri was completed in 2013, Magnolias in 2016.

The freehold developments already show better appreciation, and the small gap suggests market expectation that the leasehold projects will roll over the lease at a low cost; it is possible they may not in which case the leasehold property values drop to zero.

So far Langsuan Village is the first of the major superblocks developed, and has sold fairly strongly, although slower than freehold in the same area.

Buy or Bye?

For foreigners the ease to buy may be attractive. Super prime locations where freehold is simply not available or any project which we love is a solid reason to buy. It is likely most buyers will be occupiers or long term investors, speculators are less likely to purchase.

As always looking at total supply in the building, and for the superblocks in the whole development and surrounding area can provide a guideline of demand and supply.

The cheaper purchase price is not a sound reason to purchase unless it is a rental yielding asset in the 6%+ range. Because the lack of capital appreciation and challenges in resale, especially towards lease renewal will offset the savings when buying.

Ensure the developer has a very strong track record in development, clear understanding with a 3rd party legal review of the lease term including any promise of renewal. Full understanding of how the property will be managed is also essential, since the usual legal protection from the Condo Act is not available.